In recent years, Europe’s energy landscape has been undergoing a dramatic transformation. For decades, Russia has been Europe’s primary supplier of natural gas, oil, and coal, serving as a cornerstone of the continent’s energy security. But with the geopolitical upheaval sparked by Russia’s invasion of Ukraine in 2022, Europe’s energy dependence on Russia has been brought to the forefront of public discourse. Amid sanctions, supply cuts, and the rapid rise of alternative energy sources, the question on everyone’s mind is: Is Europe’s dependence on Russia for energy over?

The Russian Energy Grip on Europe

Before the war in Ukraine, Russia was the world’s largest exporter of natural gas and the second-largest exporter of oil. Europe, particularly countries in Central and Eastern Europe, relied heavily on Russia for energy. About 40% of the EU’s natural gas came from Russian pipelines, and a significant share of the continent’s oil and coal supplies were also Russian-sourced.

For nations like Germany, Italy, and Poland, this energy relationship was foundational to their economic development and daily life. Russian energy provided relatively cheap, reliable, and abundant supplies. However, this reliance made Europe vulnerable to political leverage, as Russia could use its energy exports as a tool of influence. During the 2009 gas dispute between Russia and Ukraine, for instance, millions of Europeans experienced gas shortages when Russia cut off supplies to Ukraine, a transit country for Russian gas pipelines.

The Impact of the Ukraine War

The invasion of Ukraine by Russia in February 2022 has been a pivotal moment in reshaping Europe’s energy landscape. Russia’s move not only violated international law but also triggered a series of punitive measures from the European Union and its allies. Sanctions were levied on Russian energy exports, targeting natural gas, oil, and coal, in an attempt to cripple the Russian economy and limit its ability to fund the war.

In response, Russia retaliated by throttling energy exports to Europe. The closure of key pipelines, including the Nord Stream 1 and 2, along with reductions in gas flows through existing infrastructure, created an immediate crisis for European countries. Energy prices skyrocketed, causing inflation and economic instability, and leaving Europe scrambling for alternatives.

The Immediate Shift: Diversification and Energy Alternatives

The sharp reduction in Russian energy supplies forced Europe to rethink its energy strategy and adopt a multi-pronged approach to diversification. Several key steps were taken to reduce dependence on Russian energy:

- Increasing LNG Imports: One of the immediate responses was to increase imports of liquefied natural gas (LNG) from countries such as the United States, Qatar, and Algeria. Europe’s LNG infrastructure quickly expanded, with new terminals being constructed to receive and process these shipments. In fact, Europe managed to import more LNG in 2022 than ever before, partly replacing Russian pipeline gas.

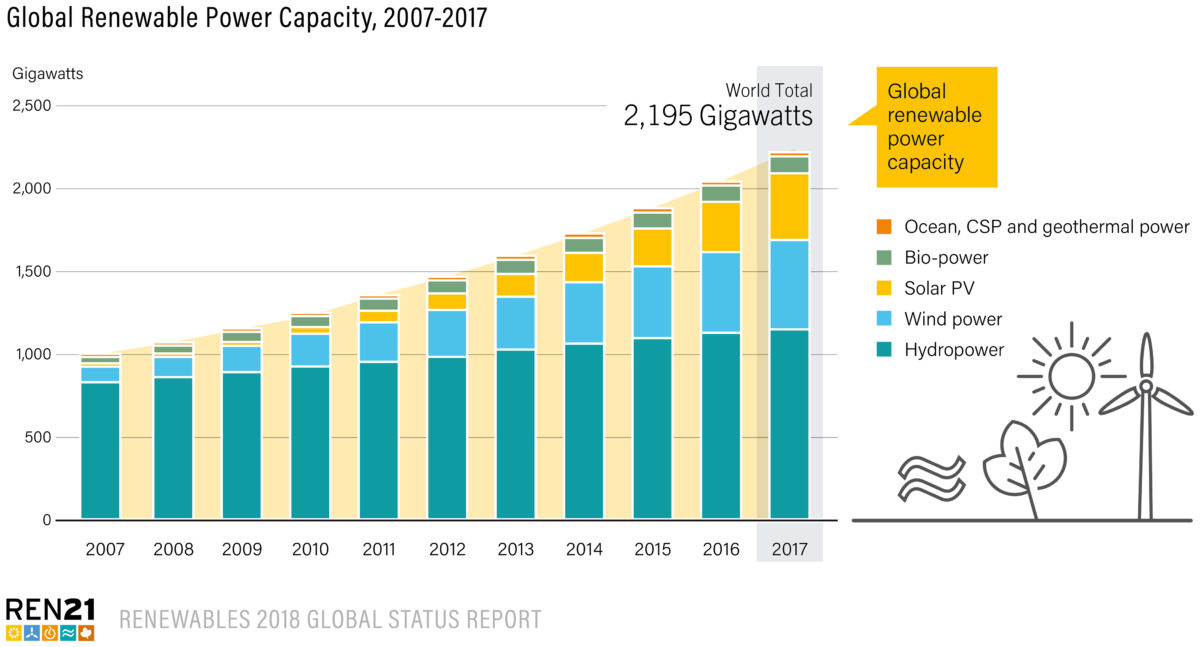

- Renewable Energy Expansion: Long before the Ukraine war, Europe had been making strides in renewable energy sources, including wind, solar, and hydroelectric power. The crisis accelerated this trend. Governments ramped up investment in renewables, with ambitious targets to transition to green energy by 2050. This is evident in the European Green Deal, which aims to reduce carbon emissions and achieve net-zero emissions by mid-century.

- Energy Efficiency Measures: In response to the energy crisis, European countries implemented programs to reduce energy consumption. From insulation programs to encourage energy-efficient housing to incentives for energy-efficient appliances and industrial processes, Europe began conserving energy in ways that had not been seen on such a scale in decades.

- Energy Storage and Batteries: With the intermittency of renewable energy sources, energy storage technologies became more critical. The development of battery storage systems, alongside hydrogen as an alternative energy vector, grew in importance. This has allowed Europe to mitigate the fluctuations in renewable energy production and make better use of clean energy during periods of low demand.

The Role of Energy Efficiency in the Transition

Energy efficiency became a key component of Europe’s energy transition. Unlike the immediate need for new energy sources, improving energy efficiency is a long-term solution that can both reduce consumption and lower reliance on external suppliers. The European Union introduced stricter regulations on building standards, the automotive industry, and industrial practices to improve energy usage. By retrofitting older buildings and enhancing grid infrastructure, Europe could reduce its overall demand for fossil fuels while simultaneously achieving environmental goals.

The adoption of energy-efficient practices, such as smart meters and demand-side management technologies, enabled consumers to track and reduce their energy consumption, while businesses found ways to decrease their operational energy demands.

The Role of Nuclear Power and Hydrocarbons

While renewable energy sources such as wind and solar power are expected to play a significant role in Europe’s energy future, they cannot completely replace fossil fuels in the short term. As such, nuclear power and remaining hydrocarbon sources continue to be important.

- Nuclear Power: Several European nations, particularly France, are heavily invested in nuclear power. France’s nuclear fleet provides around 70% of its electricity and offers a stable and low-carbon energy source. While some countries, such as Germany, have committed to phasing out nuclear power by 2030, others have revisited their nuclear policies in light of energy security concerns. The European Union has recently classified nuclear energy as a “green” energy source in its taxonomy, allowing it to attract investment for new plants and technologies.

- Continued Role of Fossil Fuels: Despite the growth of renewables, fossil fuels will remain part of the energy mix for years to come. In the short to medium term, European countries are investing in energy infrastructure that can import oil and natural gas from other sources, ensuring supply diversification. However, this is not a sustainable long-term strategy, and Europe remains focused on reducing its carbon footprint.

Energy Politics and the Geopolitical Shift

As Europe reduces its reliance on Russian energy, new geopolitical alliances are forming. Energy security is now more closely tied to political and economic strategies, with countries increasingly looking toward the Middle East, North America, and Africa for energy supplies.

- The United States has been a significant supplier of LNG to Europe, and transatlantic energy relations have grown closer. However, European countries are mindful of the potential volatility of LNG prices, especially given that the US has a more volatile domestic market than Russia once did.

- The Middle East and North Africa are also key regions in Europe’s new energy security strategy. Countries like Algeria, Libya, and Qatar have become more important suppliers of natural gas, and Europe is looking to increase its partnerships in these regions.

- Renewable Energy Cooperation: Europe is increasingly seeking cooperation with neighboring regions, such as North Africa, to develop renewable energy projects, including solar and wind farms, that could be exported to Europe. By diversifying its renewable energy sources, Europe can lessen its dependence on external suppliers while reducing carbon emissions.

Will Energy Dependence on Russia Ever Be Truly Over?

While Europe’s dependence on Russian energy has been greatly reduced in the short term, the complete severance of ties with Russia may take years to fully materialize. The infrastructure required to replace Russian energy supplies is immense, and while Europe has made remarkable strides in diversifying its sources, the transition to a completely independent and green energy system will be a gradual process.

Furthermore, energy markets remain volatile. Even as Europe reduces its dependency on Russian oil and gas, the interconnectedness of global energy markets means that energy prices remain susceptible to geopolitical events. It’s also worth noting that Europe’s energy transition will require significant investment in infrastructure and technology, as well as a sustained political commitment to green energy policies.

In conclusion, while Europe’s dependence on Russian energy is significantly reduced, it is not entirely over. However, the continent’s determination to move away from fossil fuel dependency, combined with a shift towards renewables and energy diversification, has set Europe on a path to energy independence—one that will take years to fully realize.