The Middle East has long captured the world’s attention, not just for its rich cultural heritage and historical significance but for its dynamic economic landscape. Over the past few decades, the region has evolved into an increasingly vital player in global trade, finance, and investment. The attraction of Middle Eastern markets to international investors has grown steadily as a result of several economic, geopolitical, and structural factors that make the region both a land of opportunity and a unique challenge for investors.

Economic Stability and Growth Prospects

Historically, Middle Eastern countries have relied heavily on oil and gas as the main sources of income. However, the landscape is shifting. Many governments in the region have launched ambitious diversification programs, moving away from the reliance on fossil fuels and towards knowledge-based economies, infrastructure development, and tourism. Saudi Arabia’s Vision 2030, the UAE’s “Project of the Century,” and Qatar’s National Vision 2030 are all clear examples of how the region is laying the foundation for long-term, sustainable growth.

These strategic initiatives aim to reduce the region’s dependence on oil revenues and attract global capital into non-oil sectors such as technology, education, healthcare, real estate, and finance. As a result, the Middle East has become an increasingly attractive destination for investors seeking growth opportunities in emerging markets.

Oil and Gas Wealth: A Double-Edged Sword

While the Middle East is in the midst of economic diversification, the region remains rich in oil and gas reserves, which continue to be major drivers of its economic strength. The wealth generated from petroleum resources has allowed governments to invest in large-scale infrastructure projects, luxury real estate, and other initiatives that create attractive investment opportunities.

International investors are keen on entering markets where natural resources and geopolitical significance play a key role. For example, the oil-rich states of Saudi Arabia, the UAE, and Kuwait possess considerable sovereign wealth funds (SWFs), often valued in the trillions of dollars. These funds actively seek investments abroad and are increasingly turning to sectors like technology, infrastructure, and renewable energy, which creates a ripple effect that bolsters international investments within the region itself.

However, oil prices are inherently volatile, which means that Middle Eastern markets can be affected by swings in global oil prices. Investors must therefore be aware of the long-term risks that come with the region’s reliance on petroleum exports. Yet, despite these fluctuations, oil remains a crucial stabilizing force in the economy and a key driver of investments in the Middle East.

Strategic Location and Trade Hubs

One of the major reasons for the growing international interest in Middle Eastern markets is the region’s strategic location at the crossroads of Europe, Asia, and Africa. The Middle East is often described as the world’s bridge, connecting three continents and serving as a key logistics hub for trade routes and shipping lanes. Major cities such as Dubai, Abu Dhabi, and Doha have transformed into global business hubs, offering a highly favorable environment for investors.

For example, Dubai’s position as a business center is unparalleled. The city has become the Middle East’s most important financial and tourism hub, offering free trade zones, no income taxes, and access to one of the world’s busiest airports and seaports. This connectivity to global markets makes Dubai a prime destination for international investors seeking to reach diverse consumer bases and capitalize on both regional and international trade flows.

Similarly, the Port of Jebel Ali in the UAE, one of the largest deep-water ports in the world, is a vital part of the region’s logistics infrastructure. It handles a significant portion of the region’s goods and connects to global markets through state-of-the-art shipping and air freight systems. This strategic positioning is a major asset for investors looking to capitalize on the Middle East’s trade flows.

Demographic Trends and Growing Consumer Markets

The Middle East has a young and rapidly growing population, which is another attractive feature for international investors. With an average age of just 30 years, many countries in the region benefit from a burgeoning middle class that is eager to spend on consumer goods, luxury products, and services. This growing demand has created fertile ground for both global and local companies looking to tap into new markets.

As disposable incomes rise and the middle class expands, the demand for a wide range of products and services continues to surge. Sectors such as retail, real estate, technology, entertainment, and healthcare are experiencing significant growth, attracting international investors who see vast opportunities in catering to the needs of an increasingly affluent and tech-savvy population.

For example, the rise of e-commerce in the Middle East is a testament to the changing consumer landscape. Platforms like Souq.com (now Amazon Middle East) have seen exponential growth, while new players like Noon.com and Talabat have capitalized on the growing online shopping trend. These businesses are not only serving local markets but are also reaching out to other regions, contributing to the global expansion of Middle Eastern companies.

Political Stability and Regulatory Reforms

The Middle East is often perceived as a politically unstable region due to ongoing conflicts and geopolitical tensions. While certain areas in the region do face instability, many of the Gulf Cooperation Council (GCC) countries — particularly the UAE, Qatar, and Bahrain — have demonstrated a remarkable degree of political stability. These countries have long been committed to creating attractive business environments by implementing investor-friendly regulations, offering tax incentives, and enacting economic reforms.

For example, the UAE’s introduction of long-term residency visas and its drive to encourage foreign ownership of businesses have made it easier for international investors to establish a presence in the country. Likewise, Saudi Arabia’s Vision 2030 has focused on economic reforms designed to ease restrictions on foreign investments, improve the regulatory environment, and diversify the economy away from oil dependency.

In addition to these regulatory reforms, some countries have also launched initiatives to attract international talent and investment. The introduction of 100% foreign ownership laws, tax-free zones, and an emphasis on entrepreneurship has created a business-friendly environment that appeals to international investors seeking long-term growth opportunities in a stable and secure market.

Infrastructure Development: A Key Investment Attraction

Another significant factor drawing international investors to the Middle East is the region’s ongoing focus on infrastructure development. Countries such as the UAE, Qatar, and Saudi Arabia have made substantial investments in building world-class infrastructure, including transportation networks, airports, ports, residential and commercial real estate, and healthcare facilities.

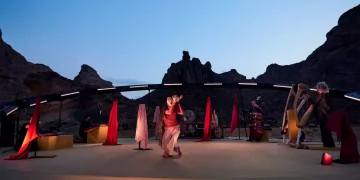

For example, the Qatar 2022 World Cup prompted an unprecedented building boom in the country, resulting in the development of new stadiums, hotels, transportation systems, and luxury real estate. Similarly, the UAE has invested heavily in its transportation infrastructure, such as the Dubai Metro and the expansion of Dubai International Airport, which is now the world’s busiest airport in terms of international passenger traffic.

These massive infrastructure projects provide investors with ample opportunities to participate in the development of new markets and to profit from the region’s long-term growth trajectory. With a significant amount of capital flowing into sectors such as construction, engineering, and logistics, the Middle East has become an attractive destination for foreign investments aimed at developing and managing cutting-edge infrastructure projects.

The Rise of the Green Economy and Renewable Energy

As the world moves towards cleaner and more sustainable energy sources, the Middle East has emerged as a key player in the green economy. Countries like the UAE and Saudi Arabia have committed to reducing their carbon footprints and transitioning to renewable energy sources. The region is well-positioned to be a leader in this global shift, with ample sunlight and space for solar energy development, as well as significant investments in wind and hydroelectric power.

For instance, the UAE’s Masdar City, a zero-carbon city being built in Abu Dhabi, is one of the most ambitious renewable energy projects in the world. Saudi Arabia’s $5 billion investment in solar and wind energy is part of its broader efforts to diversify its energy mix and reduce reliance on fossil fuels. These initiatives not only help the region meet global sustainability goals but also create attractive investment opportunities in clean energy and technology.

The Middle East’s move toward renewable energy offers a long-term growth prospect for investors who are looking to align their portfolios with environmental, social, and governance (ESG) principles. As governments in the region continue to invest in green infrastructure, the demand for innovative solutions in energy storage, clean technologies, and electric vehicles will rise, attracting new waves of capital into the market.

Conclusion

The Middle East has proven itself to be an alluring destination for international investors, driven by a combination of economic diversification, natural resource wealth, strategic positioning, demographic trends, and regulatory reforms. The region’s focus on infrastructure development, technological innovation, and the green economy further solidifies its appeal. While challenges like geopolitical risks and oil price volatility remain, the long-term prospects for growth and development in the Middle East continue to make it an attractive and increasingly stable investment hub. Investors willing to navigate the complexities of the region stand to gain from its continued economic evolution and position at the intersection of global trade.